There is lots of chatter currently about Ethereum moving from Proof of Work to the Proof of Stake consensus mechanism. So what is the difference and why does it matter?

Traditionally blockchain technology has been built on a Proof of Work (PoW) consensus mechanism to confirm transactions and mine coins. In fact when cryptocurrency was created there was really only one consensus mechanism upon which it was built, PoW. However, as with most technologies things have evolved since the early days.

Proof of Work or PoW

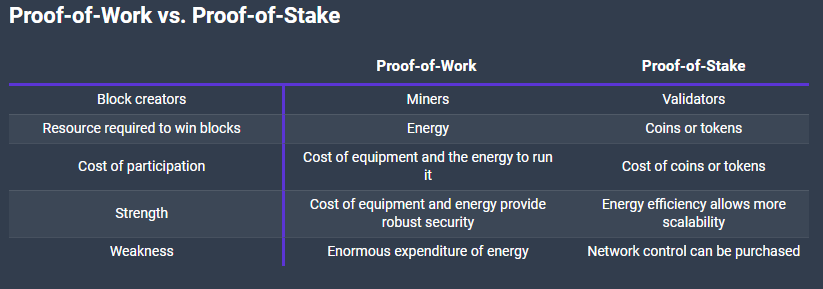

The proof of work mechanism requires ‘miners’ to solve complex mathematical equations, Solving these equations confirms transactions or creates new coins which in turn are then added to the blockchain. Miners are rewarded for their efforts with new coins. Solving these equations takes a huge volume of computational power and thus requires a lot of energy.

Proof of Stake or PoS

The proof of stake mechanism requires ‘validators’ (same as miners) to ‘stake’ their coins in order to be selected to validate transactions. Those who stake more coins have a higher chance of being selected. Once selected the validator receives a reward or fee for their efforts, rather than new coins.

The move of Ethereum from PoW to PoS is huge news because Ethereum will be one of the first of its kind to attempt such a transition, and Ethereum is also the second largest cryptocurrency by market capitalisation, behind only Bitcoin. As such, there is a lot of speculation, and trepidation, about if this transition will work, how it will work, and what effect it may have on not only Ethereum itself but also the future of blockchain technologies. The transition will occur in phases, the first of which has already occurred, and the last of which is expected later in 2022.

So why the change?

Environmental concerns are possibly the biggest driving force behind the change. Cryptocurrency has in recent years received a lot of negative attention regarding energy usage, and the PoS consensus mechanism will use a fraction of the energy required compared to PoW. Other driving forces for Ethereum at least include scalability, and speed, namely the number of transactions that can be verified per second, Ethereum currently is one of the slower blockchains averaging about 30 transactions per second, whereas with the move they are forecasting this to increase to 100,000, getting them well ahead of their fiat competitors Visa or Mastercard, averaging around 1700 transactions per second.

There are already many coins on the market using the PoS consensus mechanism. Other big names include BNB from Binance, SOL from Solana, and ADA from Cardano. PoS has been around since 2012, so already 10 years in the game, it’s just very topical right now with Ethereum’s big transition. It’s kinda like everyone sitting around waiting to see what would happen when the clock struck midnight with the millennium bug or Y2K. As with that event, Ethereum’s transition is likely to be uneventful, but for now, we remain alert, not alarmed, while we wait to find out!